F-Squared Investments

F-Squared Investments has carved a niche in the competitive landscape of asset management since its inception in 2008, emphasizing innovative strategies underpinned by rigorous analysis and risk management. The firm’s commitment to transparency and adaptability positions it uniquely to meet the diverse needs of its clientele. As market dynamics continue to evolve, it is essential to consider how F-Squared’s approach not only addresses current client objectives but also anticipates future trends. What specific strategies does the firm employ to ensure sustained growth in such a volatile environment?

Read also: Clipart:2f81czvtxgc= Fried Egg

Overview of F-Squared Investments

Founded in 2008, F Squared Investments has established itself as a prominent player in the investment management industry, specializing in providing innovative investment strategies centered around risk management and performance enhancement.

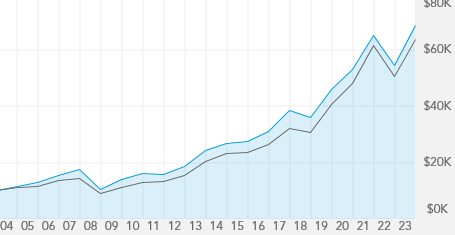

The F Squared history reflects a commitment to rigorous analysis and data-driven insights, resulting in notable F Squared performance that empowers clients to navigate complexities in financial markets while pursuing their investment goals with greater confidence.

Investment Strategies and Solutions

F-Squared Investments employs a range of sophisticated investment strategies designed to address diverse client needs while maintaining a focus on risk management and performance optimization.

Through meticulous portfolio diversification, the firm seeks to mitigate potential losses and enhance returns.

Commitment to Transparency

Transparency is a cornerstone of effective investment management, fostering trust and informed decision-making among clients.

F-Squared Investments prioritizes transparency initiatives that enhance client communication, ensuring that clients are well-informed about strategies, performance metrics, and potential risks.

This commitment not only strengthens client relationships but also empowers them with the knowledge necessary to make confident choices, ultimately supporting their investment objectives.

Future Outlook and Adaptability

As the investment landscape continues to evolve, the ability to adapt and anticipate future trends becomes increasingly vital for firms like F-Squared Investments.

By closely analyzing market trends and employing robust risk management strategies, F-Squared positions itself to capitalize on emerging opportunities.

This proactive approach not only enhances portfolio resilience but also empowers clients to navigate uncertainties, ensuring sustained growth and freedom in investment choices.

Read also: Learn All About proxyum.com

Conclusion

In the realm of investment, F-Squared Investments serves as a lighthouse, guiding clients through turbulent financial waters with innovative strategies and steadfast risk management. The firm’s commitment to transparency acts as a clear beacon, illuminating the path toward informed decision-making. As markets continue to evolve, F-Squared’s adaptability ensures the preservation of assets while seizing emerging opportunities, thereby fostering sustained growth. Thus, navigating the complexities of investment becomes a journey characterized by confidence and resilience, ultimately leading to prosperous shores.