Financial Performance Optimization Report for 652872279, 962000000, 664381965, 911217674, 3371035895, 69365000

The Financial Performance Optimization Report for the specified entities provides a critical examination of their financial metrics. It employs comparative benchmarks to reveal both strengths and weaknesses in their operations. The analysis lays the groundwork for strategic recommendations aimed at enhancing revenue and reducing costs. Additionally, it uncovers potential growth opportunities that warrant further exploration, raising essential questions about their future financial trajectories. What specific strategies can lead to sustainable success?

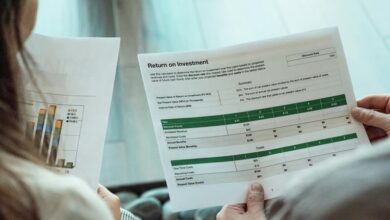

Overview of Financial Performance Metrics

While financial performance metrics serve as critical indicators of an organization’s economic health, their effective analysis requires a nuanced understanding of various components.

Financial ratios and revenue trends are essential for evaluating performance, highlighting strengths and weaknesses.

A comprehensive examination of these metrics allows stakeholders to make informed decisions, optimizing resource allocation and enhancing long-term sustainability in an increasingly competitive landscape.

Comparative Analysis of Key Performance Indicators

A robust comparative analysis of key performance indicators (KPIs) provides valuable insights into an organization’s financial standing relative to its peers and industry benchmarks.

Through performance benchmarking, organizations can assess their metrics against competitors, identifying strengths and weaknesses.

This metric assessment enables informed decision-making, allowing for a clear understanding of financial health and operational efficiency, ultimately fostering greater autonomy in strategic financial management.

Strategic Recommendations for Improvement

To enhance financial performance, organizations must implement targeted strategic recommendations that address identified weaknesses and leverage strengths.

Focused initiatives on cost reduction can streamline operations, minimizing unnecessary expenditures.

Concurrently, strategies for revenue enhancement, such as diversifying product offerings and optimizing pricing models, will drive sales growth.

Future Growth Opportunities and Considerations

What avenues are available for organizations seeking to capitalize on future growth opportunities?

Market expansion remains a viable strategy, enabling companies to penetrate new regions or demographics.

However, thorough risk assessment is essential to navigate potential challenges and ensure sustainable growth.

Conclusion

In conclusion, the Financial Performance Optimization Report illustrates that, much like a gardener tending to diverse plants, these organizations must carefully nurture their unique strengths while addressing weaknesses. By implementing strategic recommendations and seizing future growth opportunities, they can cultivate a robust financial landscape. Just as the health of a garden relies on balanced resources and attention, so too does the financial vitality of these entities depend on informed decision-making and proactive risk management for sustainable success.