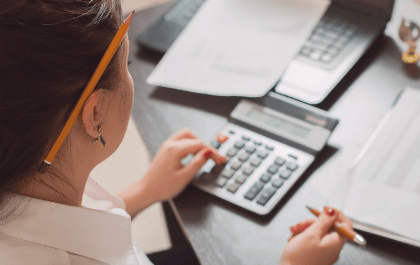

Bookkeeping Services for Accurate Financial Record Keeping

Accurate financial record-keeping is fundamental to the success and sustainability of any business, serving as the backbone for informed decision-making and stakeholder trust. The role of professional bookkeeping services cannot be overstated, as they bring specialized expertise and modern tools to the table, ensuring precision and efficiency in financial management. However, selecting the right bookkeeping partner involves more than just a review of their credentials; it requires a deep understanding of your unique business needs and the technologies available. What factors should be prioritized in this critical selection process?

Importance of Accurate Bookkeeping

Accurate bookkeeping plays a pivotal role in the financial health of a business, as it lays the groundwork for informed decision-making and strategic planning.

By ensuring financial transparency, organizations can foster trust with stakeholders while maintaining audit readiness.

This meticulous attention to detail not only enhances operational efficiency but also empowers businesses to navigate complex financial landscapes with confidence and agility.

Benefits of Professional Services

Utilizing professional bookkeeping services can significantly enhance a business’s financial management strategy.

These services provide cost savings through optimized resource allocation and reduce overhead expenses associated with in-house bookkeeping.

Furthermore, they improve time efficiency, allowing business owners to focus on core operations and strategic initiatives.

This dual benefit empowers organizations to achieve greater financial accuracy and operational freedom, ultimately driving sustainable growth.

Choosing the Right Bookkeeping Partner

Selecting the right bookkeeping partner is a critical decision that can profoundly impact a company’s financial health and operational efficiency.

Conducting a thorough experience evaluation is essential to ensure that potential partners possess relevant expertise.

Additionally, a comprehensive service comparison can highlight differences in offerings, pricing, and customer support, ultimately guiding businesses toward a partnership that aligns with their financial objectives and independence.

Tools and Technologies Used

Leveraging advanced tools and technologies is essential for modern bookkeeping services, as they enhance efficiency and accuracy in financial management.

Cloud software facilitates real-time collaboration, while automated solutions minimize human error.

Mobile apps empower users to manage finances on-the-go, and data analytics provide insights for informed decision-making.

Together, these innovations offer a robust framework for achieving precise and timely financial records.

Conclusion

In conclusion, the pursuit of precise and professional bookkeeping services significantly enhances financial fidelity and fosters fiscal fortitude. By leveraging leading-edge technologies and methodologies, businesses can achieve remarkable results in record-keeping, ensuring audit readiness and informed decision-making. The strategic selection of a suitable bookkeeping partner not only streamlines operations but also solidifies stakeholder trust. Ultimately, accurate bookkeeping acts as a cornerstone for sustainable success, supporting the overarching goals of growth and stability in an increasingly competitive marketplace.